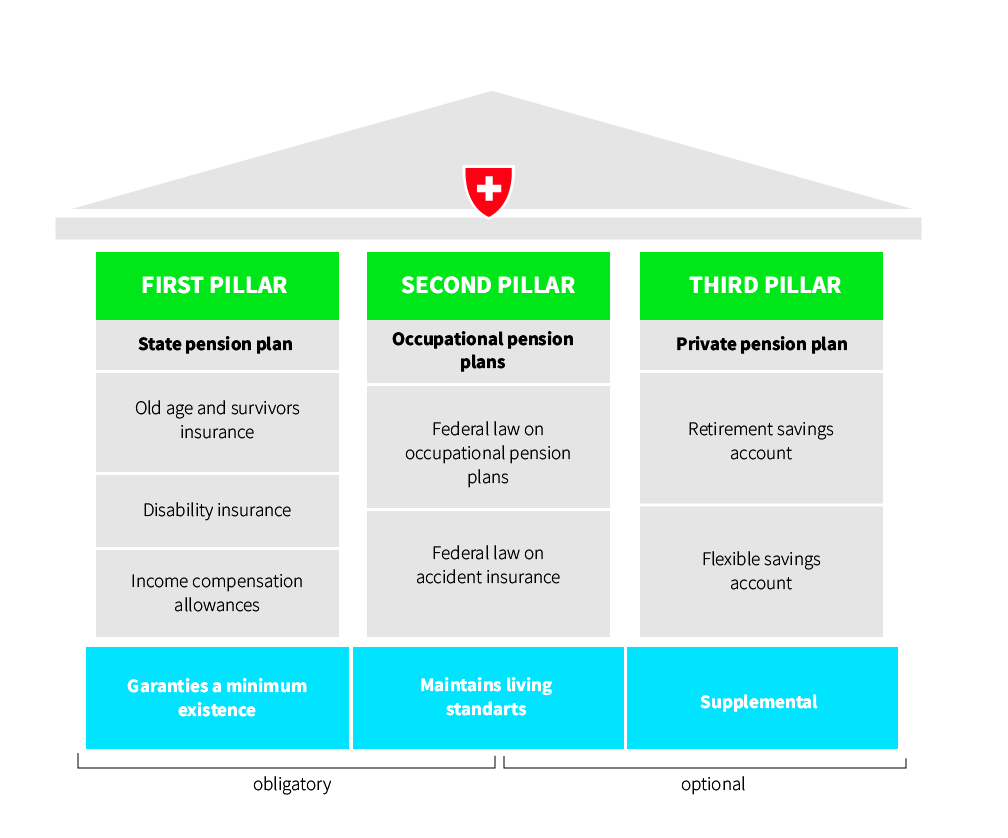

The pension provision system in Switzerland is based on the three-pillar principle. The three pillars are state, occupational and private pensions. The first pillar is obligatory and is intended to cover basis needs when you retire. The second pillar is funded by both employers and employees and is intended to allow to maintain the living standard you are accustomed to. The third pillar is optional and is intended to cover all other financial needs.

Quelle: www.swissinfo.ch

1st pillar: state pension plan

The basis of your pension provision is state insurance (AHV/AVS).providing retirees and ‘survivors’ (widows, widowers, orphans) enough money to cover their basic needs (necessary/social minimum).

The full* monthly AHV/AVS pension is (Stand 2021)

- minimum CHF 1195.

- maximum CHF 2390.

- maximum CHF 3585 (couple)

*excluding deductions for periods in which payments were not made in full

Further AHV/AVS provision available: widow(er)’s pension, orphan’s benefit, other benefits.

You can find full information on AHV/AVS for the self-employed in Switzerland can be found at www.ahv-iv.ch

2nd pillar: occupational pension plan

The purpose of this insurance is to complement the 1st pillar (AHV/AVS and IV) with a 2nd pillar (occupation pensions), so that retirees, survivors and invalids can maintain their previous standard of living. Occupational provision aims to give you a pension worth 60% of your previous salary by supplementing the AHV/AVS/IV pension.

Importrant for the (partly) self-employed and culture companies

Alongside income from employment, such as at a music or dance school, many culture professionals also earn a significant portion of their income from self-employment.

However, payments towards an occupational pension plan are not obligatory for income from self-employment. People with multiple part-time occupations often also frequently face the problem that each job does not provide sufficient income for them to qualify for occupational pension provision. The Charles Apothéloz-Foundation (CAST)’s pension fund specialises in provision for freelancers and the self-employed. But you can also take out insurance for your employees from CAST (in German) as a culture company.

3rd pillar: private pension plan

Restricted pension provision (pillar 3a) is an optional pension plan. Its defining features is the tax privilege it conveys, as payments into recognised provision plans are tax-deductible. However, payments out (upon retirement) are taxed in full in line with the 2nd pillar.

The capital in pillar 3a cannot normally be withdrawn, as it is reserved for financing retirement. Exceptions apply for example if you purchase property, become self-employed or emigrate.

Further information about private pension provision under the 3rd pillar is available at www.vorsorge-3a.ch (in German).

Freelance theatre entrepreneur Ruth Widmer talks about the financial situation for people in the arts in Switzerland.